Are you considering a new roof for your Cary, NC, home? What if you could lower the cost while improving your home’s comfort and value? It’s possible with roof tax credits and utility rebates. These programs reward homeowners for making smart, energy-efficient choices. At The Shingle Master, we’re dedicated to “Protecting What Matters.” This guide will walk you through how to qualify for these valuable savings, helping you make an informed decision for your home and family.

Understanding Roof Tax Credits & Utility Rebates

Navigating financial incentives for home upgrades in your zip code can seem complicated, but the core idea is simple. Both federal tax credits and local utility rebates for central air conditioners are designed to encourage homeowners to invest in energy efficiency improvements. These programs help offset the cost of upgrades that reduce your energy consumption.

Understanding how each one works is the first step toward maximizing your savings, especially when considering information provided on a .gov website. An energy property upgrade, like installing materials that meet ENERGY STAR standards, is often the key to unlocking these financial perks for clean energy.

Key Differences Between Tax Credits and Utility Rebates

Tax credits directly reduce your tax liability, allowing you to subtract a specified amount from the taxes owed, thus offering immediate financial relief. Utility rebates, on the other hand, provide cash back or a discount after the purchase of energy-efficient equipment, encouraging homeowners to adopt sustainable practices. Understanding these distinctions can maximize your benefits. While tax credits, which can sometimes result in excess credit, may apply to significant home improvements, utility rebates often target specific upgrades like energy-efficient roofing or appliances, enhancing overall savings.

Why Energy-Efficient Roofing Matters for Cary, NC Homeowners

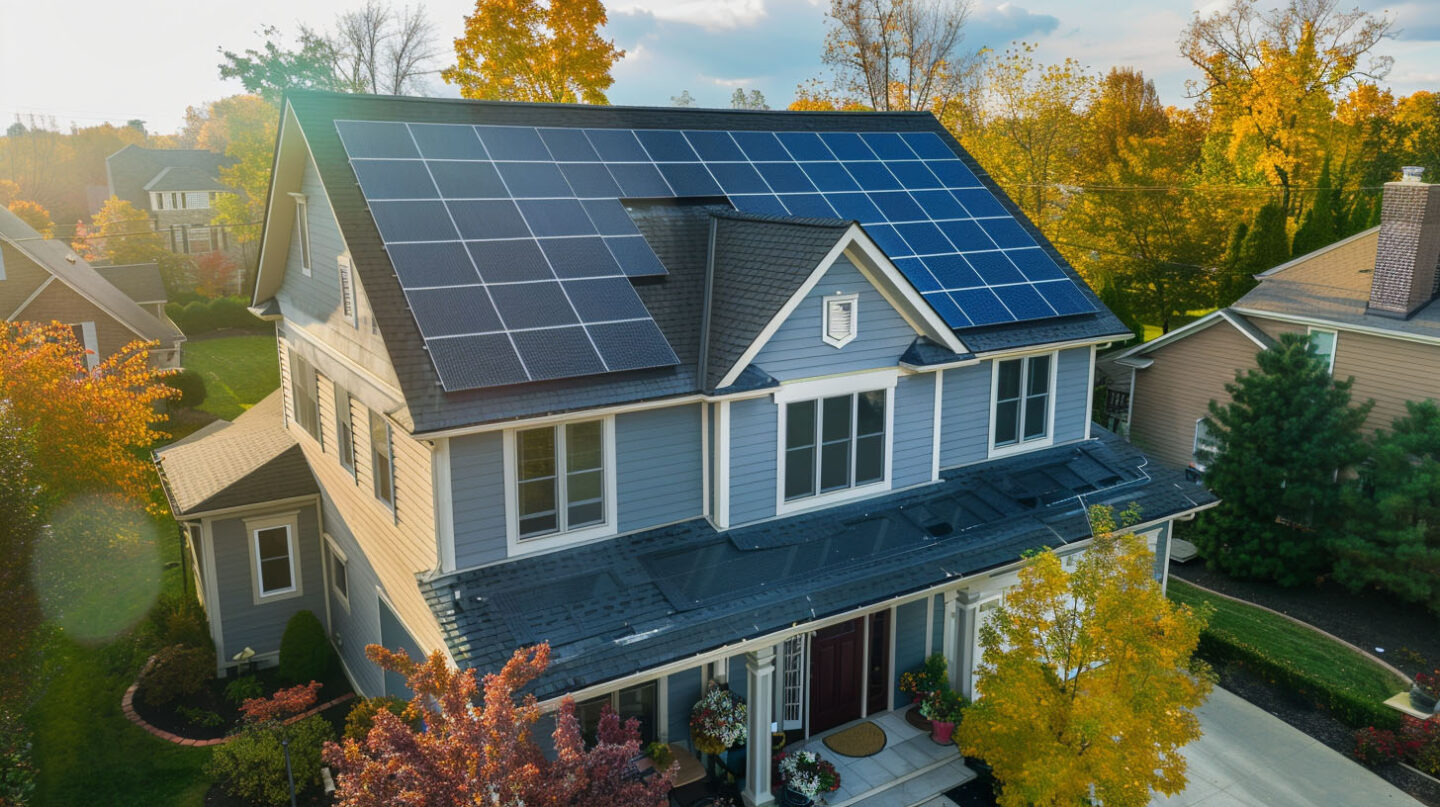

Investing in energy-efficient roofing is crucial for homeowners in Cary, NC, given the region’s varying climate and energy needs. Utilizing technologies like solar roofing tiles or ENERGY STAR certified materials reduces energy consumption and enhances home efficiency. This not only contributes to lower utility bills but also aligns with state and federal initiatives like the Inflation Reduction Act, offering potential tax incentives for upgrades. Energy-efficient roofs represent both an environmentally friendly choice and a smart financial decision for the future.

Federal Programs for Energy-Efficient Roofing

The federal government offers significant incentives to homeowners who upgrade their principal residence with clean energy solutions. Thanks to measures like the Inflation Reduction Act, programs such as the Energy Efficient Home Improvement Credit, which includes annual limits on the amount of credit you can claim, and the Residential Clean Energy Credit are available through 2032. These federal tax credit programs are designed to lower the financial barrier to adopting energy efficiency standards. To benefit, your project must meet specific eligibility requirements. Let’s look at what you need to know to qualify for these valuable credits.

Eligibility Requirements Under Current Guidelines

Meeting the eligibility criteria for tax credits related to energy-efficient roofing is crucial for homeowners aiming to reduce their environmental footprint. Generally, the upgrades must enhance energy efficiency in a taxpayer’s principal residence. Compliance with energy efficiency standards set by relevant authorities is essential, especially to qualify for incentives under the Inflation Reduction Act. Additionally, documentation proving installation of recognized products, like Energy Star certified roofing or solar panels, significantly aids in securing these benefits, thereby maximizing potential tax savings.

Recognized Improvements: Solar Panels, Certified Roof Products, and Insulation

Significant upgrades like solar panels, certified roof products, and hot water boilers, along with clean energy equipment insulation, directly enhance energy efficiency in homes. These recognized improvements can qualify for various credits and rebates, benefiting homeowners with potential tax savings. Solar energy systems, particularly, align with the residential clean energy credit, providing an avenue for reducing tax liabilities. Additionally, utilizing energy Star certified insulation materials not only boosts comfort but ensures compliance with energy efficiency standards, making your home more sustainable while contributing to long-term savings.

Qualifying for North Carolina Utility Rebates

Beyond federal tax incentives, you may be able to save even more with local programs. North Carolina utility companies often provide rebates to their customers for making energy-saving upgrades. These rebate programs are separate from the federal home improvement credit and can sometimes be combined for maximum savings.

These incentives can cover a range of upgrades, from new heat pumps to insulation. The first step is to see what your local provider offers for roofing-related improvements.

Types of Roof Upgrades That May Qualify

Various roof upgrades can enhance energy efficiency and potentially qualify for tax incentives or rebates. Energy Star certified roofing materials, like solar roofing tiles, are excellent options. Traditional roofing systems, when enhanced with better insulation materials, can also make the cut. Additionally, installing a cooling system that integrates with a new roof may improve efficiency. Homeowners should evaluate their upgrades against energy efficiency standards to ensure eligibility, maximizing potential savings and future tax credits.

What’s Next

Maximizing benefits from roof tax credits and utility rebates requires a proactive approach to energy efficiency. Homeowners can significantly enhance their financial standing by taking advantage of available incentives. Understanding eligibility requirements, recognizing valued improvements, and being aware of tax savings can lead to substantial savings on future tax years. Engaging with federal programs and local initiatives not only promotes sustainable practices but also elevates home value in a shifting market focused on clean energy solutions. Our awards, including GAF Master Elite Contractor, BBB A+, Haag Certified Inspector, NC Licensed General Contractor, Raleigh’s Best Roofing Contractor, NHBA, and membership in the Raleigh Chamber of Commerce, further underscore our commitment to quality and excellence in roofing services.

Frequently Asked Questions

Can I get a tax credit for a new roof?

Generally, a standard roof replacement does not qualify for a tax credit. However, specific components that enhance energy efficiency, such as qualifying roof insulation or solar shingles that are part of the home improvement, may be eligible. The focus of the home energy credit is on the energy-saving function.

What is the tax credit for roof replacement in 2025?

In 2025, homeowners in the United States can expect a tax credit for roof replacement, which may cover a percentage of eligible expenses. This incentive aims to encourage energy-efficient upgrades, reducing overall costs while promoting sustainable practices in residential roofing systems. Be sure to check IRS guidelines for updates.

Read our blog: Dormer & Wall Flashing: Step vs Counter-Flashing Details